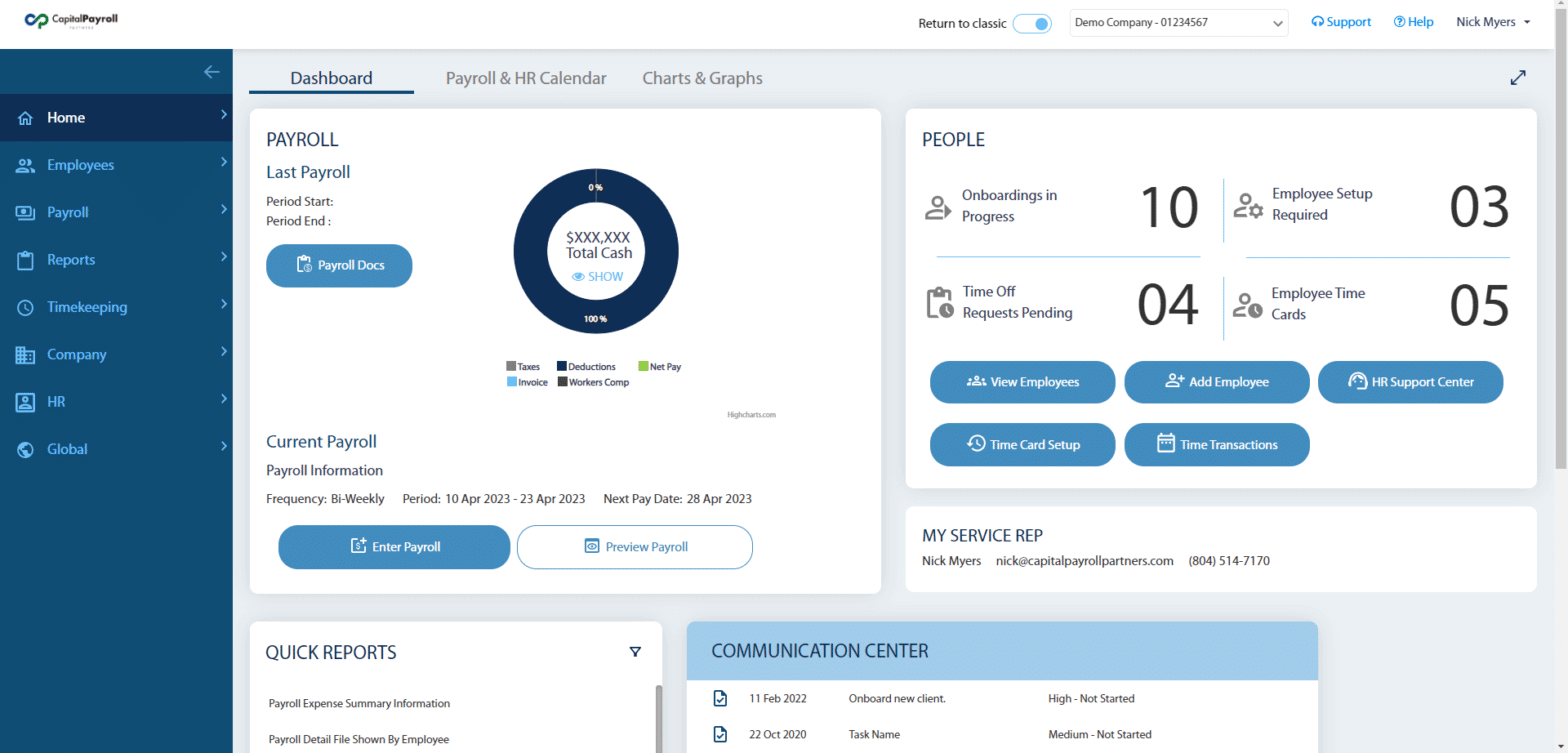

Transitioning to the ‘GO NEXT’ Payroll Experience

The “Employer on the GO” classic service is being updated with a more modern, user-friendly interface and additional features. You may have been using this product for many months now as it has gone through a beta release with the option to switch back to the classic version of Employer on the GO. The new… Continue reading Transitioning to the ‘GO NEXT’ Payroll Experience

Understanding the Key Differences between FLSA Exempt and FLSA Non-Exempt Employees in the United States

The Fair Labor Standards Act (FLSA) is an important piece of labor legislation designed to protect the rights of employees and ensure fair treatment throughout the workplace. Employees and employers must be aware of what their FLSA classification is. An employee is either FLSA exempt and FLSA non-exempt. So how do you know the classification… Continue reading Understanding the Key Differences between FLSA Exempt and FLSA Non-Exempt Employees in the United States

Importance of a Good PTO Policy

Paid time off (PTO) is an critical part of your company’s overall benefits package… if you have a good policy. It is an essential component of a comprehensive employee benefits package, and demonstrates to your employees that you value their work-life balance and well-being. A well-designed and planned PTO policy will also help attract and… Continue reading Importance of a Good PTO Policy

Employee Tax Withholding: Advice for Employers

Tax season is here, and it’s likely that at least one of your employees is asking you why their refund was so big this year, or worse… why they owe so much money. You’re not a tax professional so if you don’t know the answer, that’s normal! However, we’re here to give you some quick… Continue reading Employee Tax Withholding: Advice for Employers

What Is The Employee Retention Credit (ERC) and How Can You Benefit From It?

It’s tax filing season, and our clients are working hard to close out their 2022 filings. However, there’s a potentially huge payroll tax credit some businesses are missing – and we want to make sure that doesn’t happen to any of our clients! That tax credit is called the Employee Retention Credit (ERC). If you… Continue reading What Is The Employee Retention Credit (ERC) and How Can You Benefit From It?

Most Common Payroll Mistakes

A well executed payroll run is central to every aspect of your business. After all, without a successful payroll run, none of your employees (or you!) can get paid… so it’s crucial that you get it right, every single time. Unfortunately, that’s easier said than done – and payroll mistakes happen more often than they… Continue reading Most Common Payroll Mistakes

Vacation Time is a Benefit, Bonus, and Boost for your Team

Vacation time can be a polarizing subject for employers. Employers are always reticent to pay for someone to not do their job. Employees, on the other hand, quite enjoy having the time off when it doesn’t impact their salary. However, we suggest reframing how you think about vacation time and PTO. Instead of thinking of… Continue reading Vacation Time is a Benefit, Bonus, and Boost for your Team

How are Bonuses Taxed?

Bonuses are a popular way to increase employee loyalty and reward a year’s worth of “jobs well done”. However… as far as payroll goes, they are often misunderstood. With those holiday bonuses on the way, let’s cover one of the most common end-of-year payroll questions: how are bonuses taxed? It’s an oft-repeated question, especially at… Continue reading How are Bonuses Taxed?

Giving Back to Our Clients and Community

Holiday season is upon us! Before you know it you’ll be gobbling down Turkey with the family and opening presents with the kids. It’s a special time of year, full of giving and charity… and we are eager to do a little bit of both. That’s why, starting in November – we’re launching our Holiday… Continue reading Giving Back to Our Clients and Community

When To Outsource Your Small Business Payroll

Let’s face it: for a small business, payroll management can be the most stressful task in your month-to-month operations. There’s so much minutiae, so much paperwork, and so many rules & regulations. It can be incredibly time consuming, but you absolutely cannot take any shortcuts… the stakes are far too high. If you make a… Continue reading When To Outsource Your Small Business Payroll