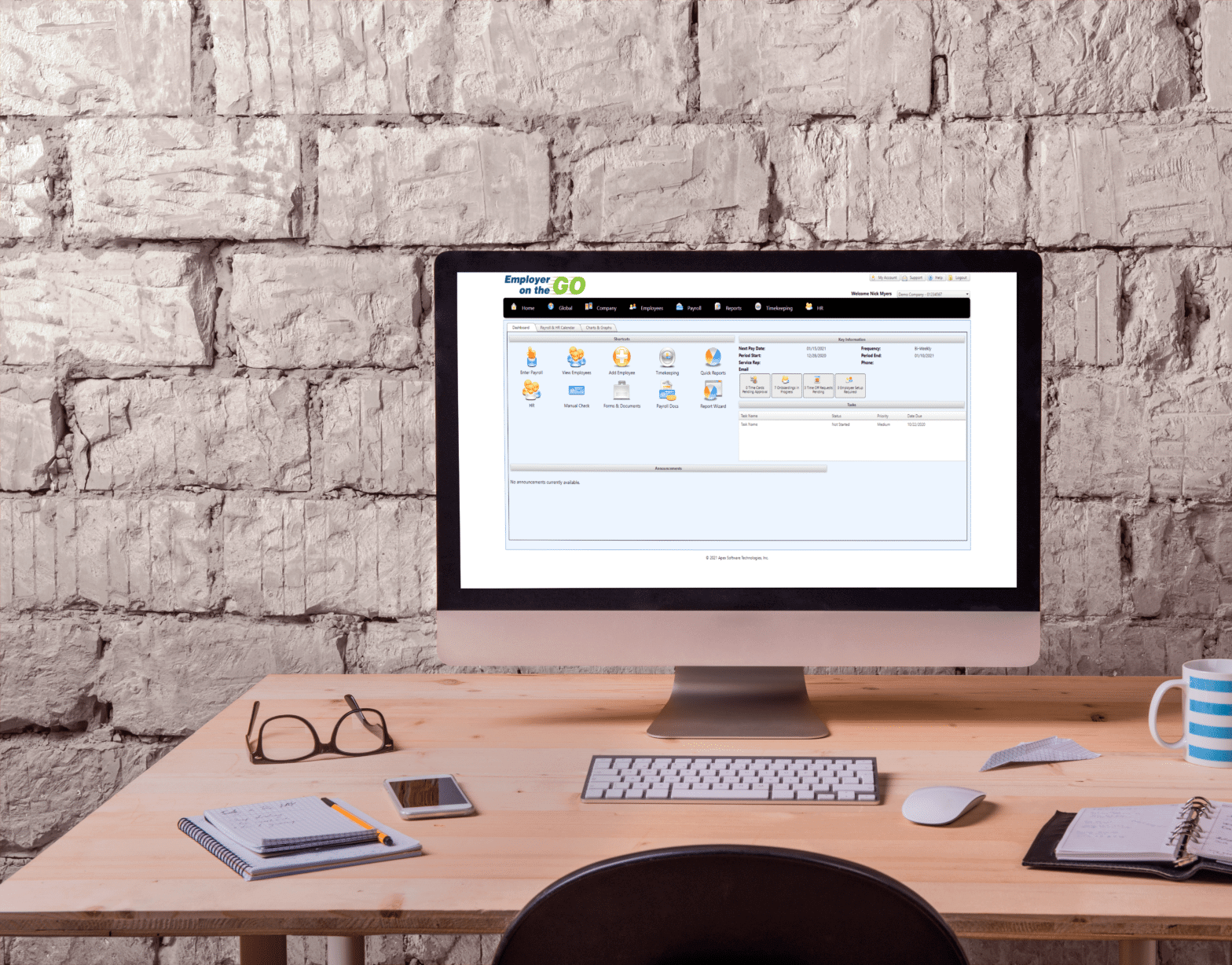

Paperless Payroll

Paperless payroll is, as the name implies, a paper-free (digital) payroll fulfillment process that has gained a massive amount of popularity in recent years – which was accelerated by the pandemic. There are tons of benefits to switching away from the traditional payroll process – benefits which we’ll list below! Keep reading… The Benefits Of… Continue reading Paperless Payroll

Paid Vacation Rules

Paid vacation is one of the most common employee benefits offered by employers. Employers are in control when determining home many days of vacation to offer, who can take vacation, how paid vacation days accrues, and when vacation days can be used – so long as they adhere to state regulations. While there are few… Continue reading Paid Vacation Rules

Post-Pandemic Business Health Concerns

While the pandemic has seemingly run its course, it is still impacting how America does business. Rules are changing frequently, sometimes-conflicting guidelines are being issued, and new laws are being passed. Avoiding litigation is a prime concern, as is making sure your top talent is happy, safe, and secure. The 5 most pressing post-pandemic business… Continue reading Post-Pandemic Business Health Concerns

Creating a Post-Pandemic Talent Retention Plan

Attracting talent is a necessary part of the Human Resources equation… but a small business that is able to retain their most talented employees has the potential to grow into a long lived, profitable company. On top of our payroll services, our role with many of our partners is working with them on talent retention.… Continue reading Creating a Post-Pandemic Talent Retention Plan

DOL Withdraws Independent Contractor Rule

In January 2021, the Department of Labor issued a rule clarifying the standard for employees versus independent contractors under the Fair Labor Standards Act. Now, as of May 2021, the Department of Labor withdrew the “Independent Contractor Status Under the Fair Labor Standards Act” final rule. According to the Society for Human Resource Management, “The… Continue reading DOL Withdraws Independent Contractor Rule

5 Employee Hiring Considerations in a New Era

While creating your company’s hiring plan for a post-COVID world, you need to adapt to a new reality. To begin with, your employee hiring considerations should include these trends: 1. Talent Shortage There is an ongoing talent shortage in many industries, making the hiring more competitive than it has been in a long time. Businesses… Continue reading 5 Employee Hiring Considerations in a New Era

Could Remote Work Be Here to Stay?

Even as vaccines roll out, many employees have embraced remote work and aren’t eager to return to the physical office. 70% of employees would like to continue to work remotely part of the time post-COVID-19, according to Glassdoor. Research from PricewaterhouseCoopers showed that employers and employees disagree about what the post-pandemic return to work might… Continue reading Could Remote Work Be Here to Stay?

Why Your Company Needs an Employee Handbook

The employee handbook has always been a great and valuable resource for employers. But recently, it has become more important than ever. The employee handbook can no longer viewed as simply a communication tool for employers. It’s now regarded as a protection strategy as well. The handbook can be your recipe for onboarding success and… Continue reading Why Your Company Needs an Employee Handbook

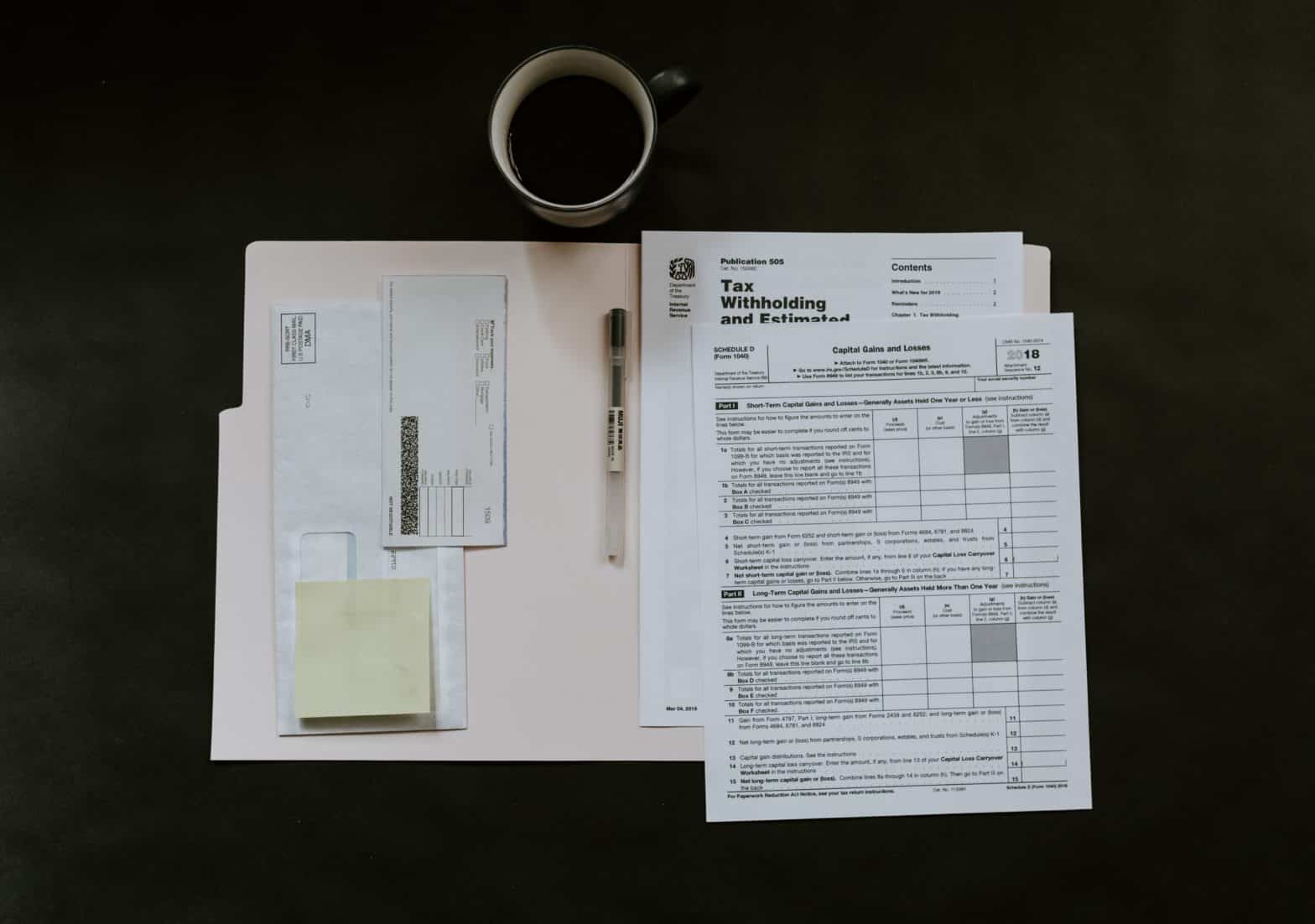

Employers Get Tax Breaks for Vaccination Leave

Washington wants everyone to get a COVID-19 shot, so it is giving a refundable tax credit to employers who grant paid time-off to staff to receive—or recover from—a vaccination. Small and midsize employers, and certain governmental employers, can claim refundable tax credits that reimburse them for the cost of providing paid sick and family vaccination… Continue reading Employers Get Tax Breaks for Vaccination Leave

14 Important Payroll Terms You Should Know

Regardless of your level of involvement in payroll, there are certain terms that you should know. Below is a roundup of words that are commonly used in the payroll industry. After-tax deductions These deductions are subtracted from employees’ wages after pretax deductions and payroll taxes have been taken out. After-tax deductions — such as wage… Continue reading 14 Important Payroll Terms You Should Know