Importance of a Good PTO Policy

Paid time off (PTO) is an critical part of your company’s overall benefits package… if you have a good policy. It is an essential component of a comprehensive employee benefits package, and demonstrates to your employees that you value their work-life balance and well-being. A well-designed and planned PTO policy will also help attract and… Continue reading Importance of a Good PTO Policy

What Is The Employee Retention Credit (ERC) and How Can You Benefit From It?

It’s tax filing season, and our clients are working hard to close out their 2022 filings. However, there’s a potentially huge payroll tax credit some businesses are missing – and we want to make sure that doesn’t happen to any of our clients! That tax credit is called the Employee Retention Credit (ERC). If you… Continue reading What Is The Employee Retention Credit (ERC) and How Can You Benefit From It?

Vacation Time is a Benefit, Bonus, and Boost for your Team

Vacation time can be a polarizing subject for employers. Employers are always reticent to pay for someone to not do their job. Employees, on the other hand, quite enjoy having the time off when it doesn’t impact their salary. However, we suggest reframing how you think about vacation time and PTO. Instead of thinking of… Continue reading Vacation Time is a Benefit, Bonus, and Boost for your Team

How are Bonuses Taxed?

Bonuses are a popular way to increase employee loyalty and reward a year’s worth of “jobs well done”. However… as far as payroll goes, they are often misunderstood. With those holiday bonuses on the way, let’s cover one of the most common end-of-year payroll questions: how are bonuses taxed? It’s an oft-repeated question, especially at… Continue reading How are Bonuses Taxed?

When To Outsource Your Small Business Payroll

Let’s face it: for a small business, payroll management can be the most stressful task in your month-to-month operations. There’s so much minutiae, so much paperwork, and so many rules & regulations. It can be incredibly time consuming, but you absolutely cannot take any shortcuts… the stakes are far too high. If you make a… Continue reading When To Outsource Your Small Business Payroll

Remote Onboarding in the Modern Age

There’s something to be said for starting off on the right foot, and if your onboarding process is antiquated, cumbersome or not representative of your company’s capabilities and culture, it can send the wrong message from the get-go. A well-defined but flexible onboarding process can be the difference between a new star employee and having… Continue reading Remote Onboarding in the Modern Age

Employment Record Retention: What Are the Federal Laws?

An important question to ask yourself when dealing with employment (and really any business-related paperwork) is how long are you required to keep the records? Unfortunately when it comes to record retention, there is a myriad of answers and a multitude of regulations for different scenarios. We’ve summarized the most common federal laws that relate… Continue reading Employment Record Retention: What Are the Federal Laws?

Introducing Competency-Based Interviews at Your Business

It might sound like common sense, but you’d be surprised how many firms underestimate the importance of competency-based interviews. Ongoing research shows that competency-based hiring procedures not only improve the initial quality of hires, but also increase employee retention levels and grants access to wider, more diverse field of potential candidates. Surveys show employers note… Continue reading Introducing Competency-Based Interviews at Your Business

Employee Retention in a Competitive Market

Lockdown furloughs forced a large cohort of hourly workers out of their jobs, and because hourly workers don’t tend to be married to their industry, there’s a massive bidding war going on right now for their employment. That means if you’re hiring for an hourly job at your company, you’re not just competing against the… Continue reading Employee Retention in a Competitive Market

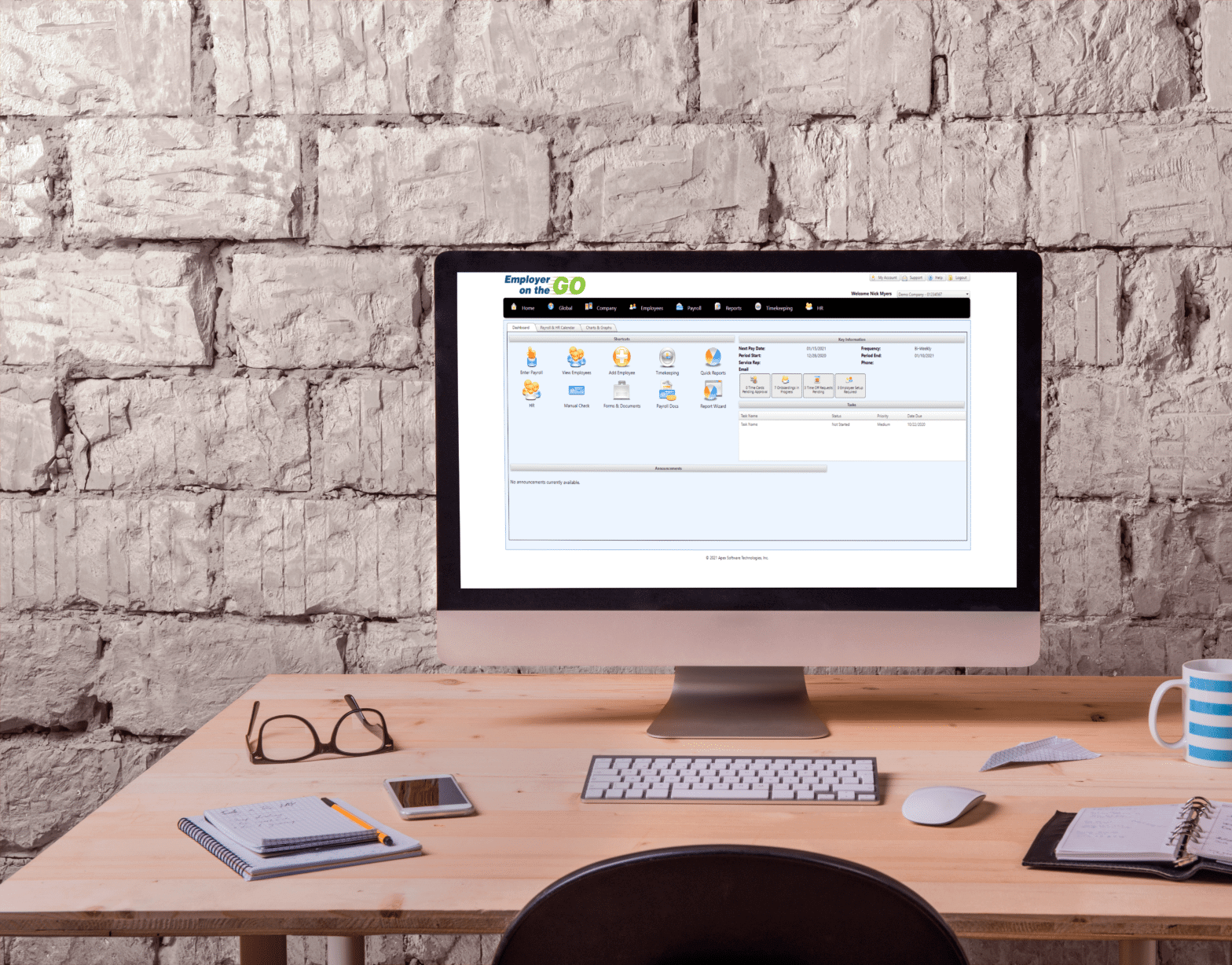

How Easy is it to Outsource Your Payroll?

The decision to outsource your payroll can seem like a difficult one, but it’s well worth it. Not only will outsourcing your payroll to Capital Payroll Partners save you untold amounts of time, but you’ll also be insuring that your business is compliant with ever-changing regulations. That all sounds great, right? Here’s even better news:… Continue reading How Easy is it to Outsource Your Payroll?