2025 401k Contribution Limits

Good news for retirement savers! The Internal Revenue Service (IRS) has announced that 2025 401k contribution limits will increase to $23,500. This represents a $500 increase from the 2024 limit. What does this mean for you? Higher Contribution Limits: You can now contribute more to your 401k plan, helping you save more for retirement. Increased… Continue reading 2025 401k Contribution Limits

DOL Increases Minimum Salary for Exempt Employees

The U.S. Department of Labor (DOL) has set increases to the minimum salary for many exempt employees. This is a significant change that will impact businesses nationwide. Here’s a breakdown of what you need to know: The Increase: The new rule implements a two-step increase for exempt executive, administrative, and professional employees (EAP): Current: Minimum salary… Continue reading DOL Increases Minimum Salary for Exempt Employees

Safeguard Your Business: Ensuring Payroll Protection for Unexpected Financial Challenges

As a business owner, you understand the importance of timely and consistent payroll. Not only is it a legal obligation, but it also plays a crucial role in maintaining employee satisfaction and loyalty. However, unexpected financial challenges can make it difficult to meet payroll demands, leading to stress and potential consequences for your business. Smart… Continue reading Safeguard Your Business: Ensuring Payroll Protection for Unexpected Financial Challenges

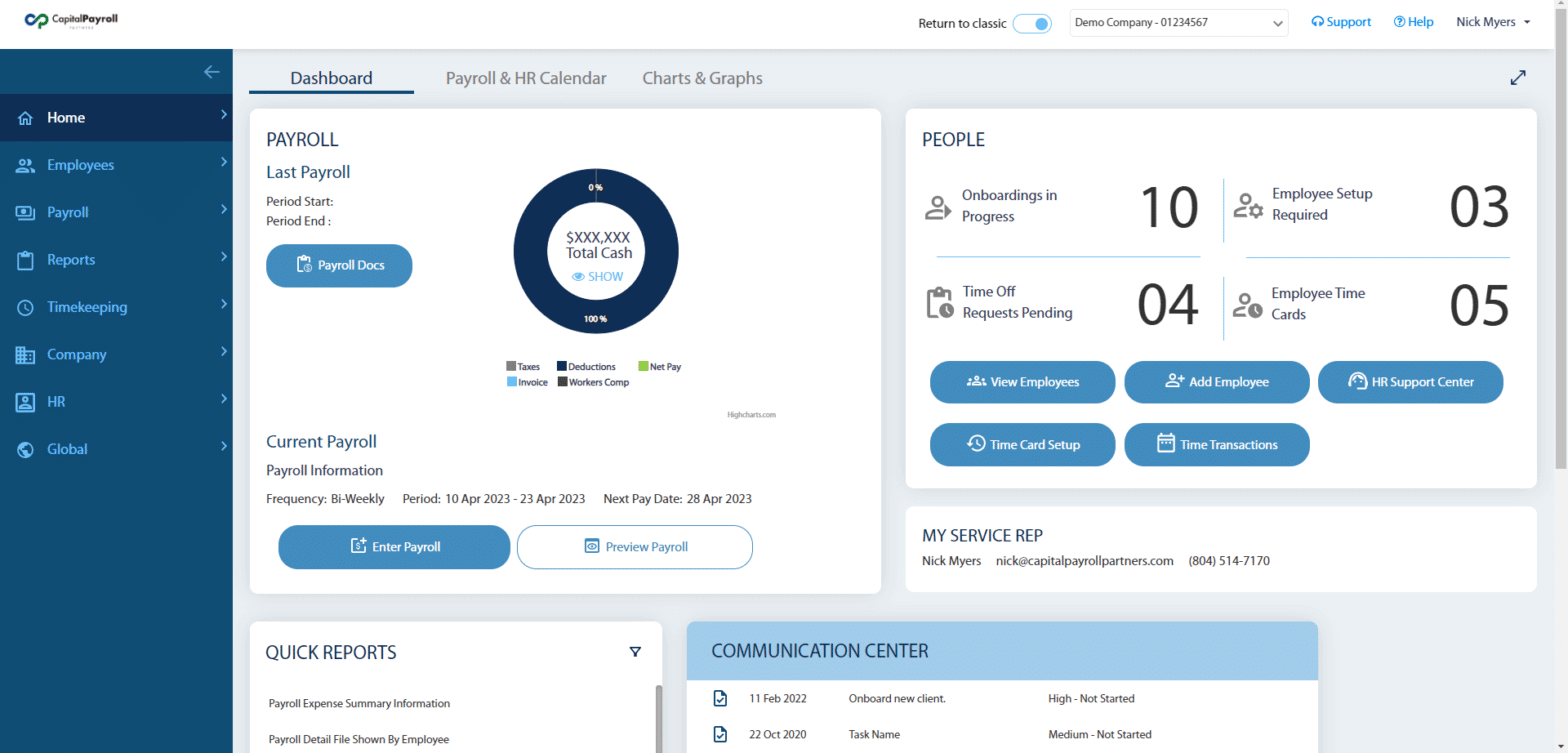

Transitioning to the ‘GO NEXT’ Payroll Experience

The “Employer on the GO” classic service is being updated with a more modern, user-friendly interface and additional features. You may have been using this product for many months now as it has gone through a beta release with the option to switch back to the classic version of Employer on the GO. The new… Continue reading Transitioning to the ‘GO NEXT’ Payroll Experience

Understanding the Key Differences between FLSA Exempt and FLSA Non-Exempt Employees in the United States

The Fair Labor Standards Act (FLSA) is an important piece of labor legislation designed to protect the rights of employees and ensure fair treatment throughout the workplace. Employees and employers must be aware of what their FLSA classification is. An employee is either FLSA exempt and FLSA non-exempt. So how do you know the classification… Continue reading Understanding the Key Differences between FLSA Exempt and FLSA Non-Exempt Employees in the United States

What Is The Employee Retention Credit (ERC) and How Can You Benefit From It?

It’s tax filing season, and our clients are working hard to close out their 2022 filings. However, there’s a potentially huge payroll tax credit some businesses are missing – and we want to make sure that doesn’t happen to any of our clients! That tax credit is called the Employee Retention Credit (ERC). If you… Continue reading What Is The Employee Retention Credit (ERC) and How Can You Benefit From It?

Most Common Payroll Mistakes

A well executed payroll run is central to every aspect of your business. After all, without a successful payroll run, none of your employees (or you!) can get paid… so it’s crucial that you get it right, every single time. Unfortunately, that’s easier said than done – and payroll mistakes happen more often than they… Continue reading Most Common Payroll Mistakes

How are Bonuses Taxed?

Bonuses are a popular way to increase employee loyalty and reward a year’s worth of “jobs well done”. However… as far as payroll goes, they are often misunderstood. With those holiday bonuses on the way, let’s cover one of the most common end-of-year payroll questions: how are bonuses taxed? It’s an oft-repeated question, especially at… Continue reading How are Bonuses Taxed?

Should You Pay an Employee Who Resigns With Two Weeks Notice?

When one of your employees puts in their two weeks notice, they may think that the heads-up time they’re giving you is doing you a favor. While the extra time to prepare for their departure can certainly help, you can run into some big time HR and Payroll headaches – especially if you aren’t aware… Continue reading Should You Pay an Employee Who Resigns With Two Weeks Notice?

Employment Record Retention: What Are the Federal Laws?

An important question to ask yourself when dealing with employment (and really any business-related paperwork) is how long are you required to keep the records? Unfortunately when it comes to record retention, there is a myriad of answers and a multitude of regulations for different scenarios. We’ve summarized the most common federal laws that relate… Continue reading Employment Record Retention: What Are the Federal Laws?