Payroll Security and Data Protection

You may have heard the recent news about Kronos Workforce Central, a payroll and HR system, that was victimized by a ransomware attack and will not be able to provide crucial services to their clients for several weeks. The disruption is so severe that they are urging their customers to look elsewhere for workforce management… Continue reading Payroll Security and Data Protection

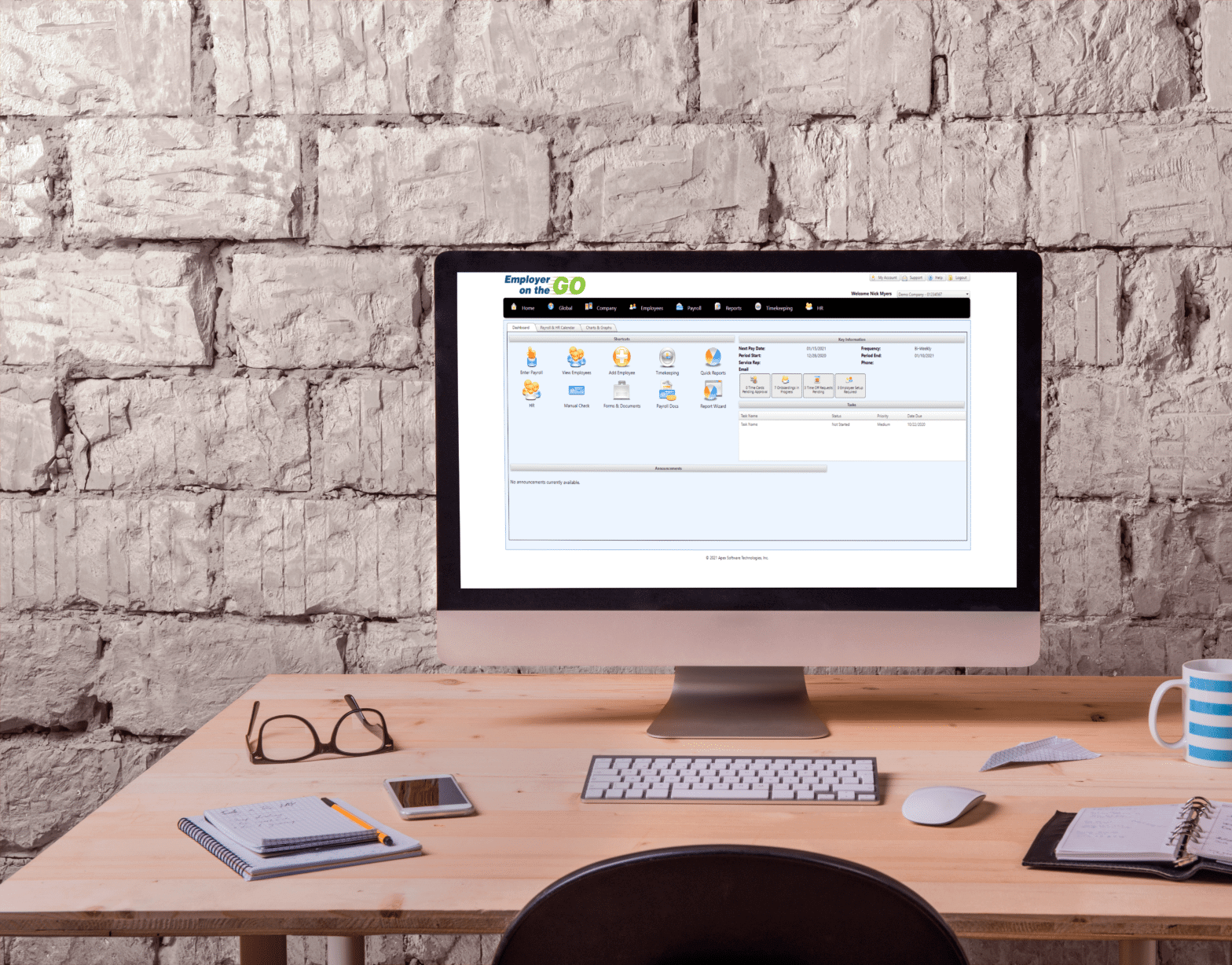

How Easy is it to Outsource Your Payroll?

The decision to outsource your payroll can seem like a difficult one, but it’s well worth it. Not only will outsourcing your payroll to Capital Payroll Partners save you untold amounts of time, but you’ll also be insuring that your business is compliant with ever-changing regulations. That all sounds great, right? Here’s even better news:… Continue reading How Easy is it to Outsource Your Payroll?

Why Choosing a Local Payroll Provider is the Right Decision for your Business

Large businesses of 500+ employees are typically able to have their own, in-house payroll department, or have big money deals in place with the payroll giants to handle it for them. But the vast majority of small and medium businesses are not able to fund their own payroll department (complete with salaries, benefits, insurance, etc… Continue reading Why Choosing a Local Payroll Provider is the Right Decision for your Business

How to Create a Successful Bonus Program

Bonuses and incentive programs are some of the best ways to motivate employees. However, in order for them to work, they must be equitable, realistic, achievable, and concise. Therefore, a successful bonus program must be thoughtfully designed. Boiled down, a bonus is simply extra money, paid to employees, in addition to their wages or salary.… Continue reading How to Create a Successful Bonus Program

Choosing the Right Salaries for New Employees

Determining the optimal salaries for new employees can be a complex calculation – and the math can change employee-by-employee… even at the same position/level. In order to minimize turnover, you need to set a range for how much employees in each position should be paid. This range is based on your expectations out of the… Continue reading Choosing the Right Salaries for New Employees

Are Your Employees… Employees?

Are you sure you’re classifying… and paying… each of your employees correctly? The determination between whether an employee is a standard employee or an independent contractor has always been a source confusion and frustration. It’s essential for businesses to get it right, because the consequences can be costly. Fortunately, the IRS has some fairly clear… Continue reading Are Your Employees… Employees?

FLSA Mistakes To Avoid

Almost every employer is required to adhere to the Fair Labor Standards Act – the FLSA. However, that’s oftentimes easier said than done. The FLSA is a complex framework, and mistakes are both common and costly – especially for smaller businesses. The Fair Labor Standards Act was enacted in 1938 after a rising demand for… Continue reading FLSA Mistakes To Avoid

Paperless Payroll

Paperless payroll is, as the name implies, a paper-free (digital) payroll fulfillment process that has gained a massive amount of popularity in recent years – which was accelerated by the pandemic. There are tons of benefits to switching away from the traditional payroll process – benefits which we’ll list below! Keep reading… The Benefits Of… Continue reading Paperless Payroll

DOL Withdraws Independent Contractor Rule

In January 2021, the Department of Labor issued a rule clarifying the standard for employees versus independent contractors under the Fair Labor Standards Act. Now, as of May 2021, the Department of Labor withdrew the “Independent Contractor Status Under the Fair Labor Standards Act” final rule. According to the Society for Human Resource Management, “The… Continue reading DOL Withdraws Independent Contractor Rule

14 Important Payroll Terms You Should Know

Regardless of your level of involvement in payroll, there are certain terms that you should know. Below is a roundup of words that are commonly used in the payroll industry. After-tax deductions These deductions are subtracted from employees’ wages after pretax deductions and payroll taxes have been taken out. After-tax deductions — such as wage… Continue reading 14 Important Payroll Terms You Should Know