Navigating New Hire Paperwork

Hiring new employees is exciting, but it also comes with a plenty of paperwork. Staying compliant with all the federal and state regulations can feel overwhelming. This blog post aims to demystify the process and guide you through the essential legal requirements for navigating new hire paperwork in the US. Key Forms and Deadlines: Form… Continue reading Navigating New Hire Paperwork

Demystifying the W-2: A Clear and Concise Guide for Employees

Ah, the W-2. That mysterious, seemingly hieroglyphic document that arrives each January, leaving many of us scratching our heads and muttering, “What does it all mean?” Fear not, fellow wage earners! This W-2 guide for employees is here to shed light on its secrets, transforming it from a cryptic puzzle into a straightforward summary of… Continue reading Demystifying the W-2: A Clear and Concise Guide for Employees

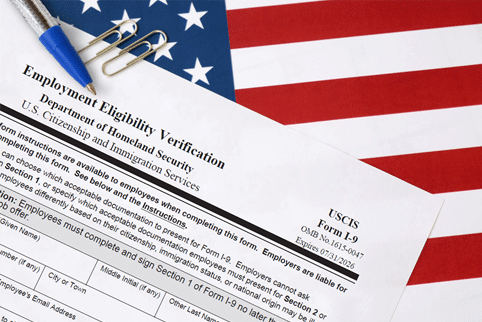

New I-9 Rules for 2024: Everything Employers Need to Know

The Internal Revenue Service (IRS) has released a new version of Form I-9, Employment Eligibility Verification, which will be required for all new hires starting in 2024. The new form includes some important changes that employers need to be aware of. Review the new I-9 rules for 2024 below. New E-Verify Checkbox The new Form… Continue reading New I-9 Rules for 2024: Everything Employers Need to Know

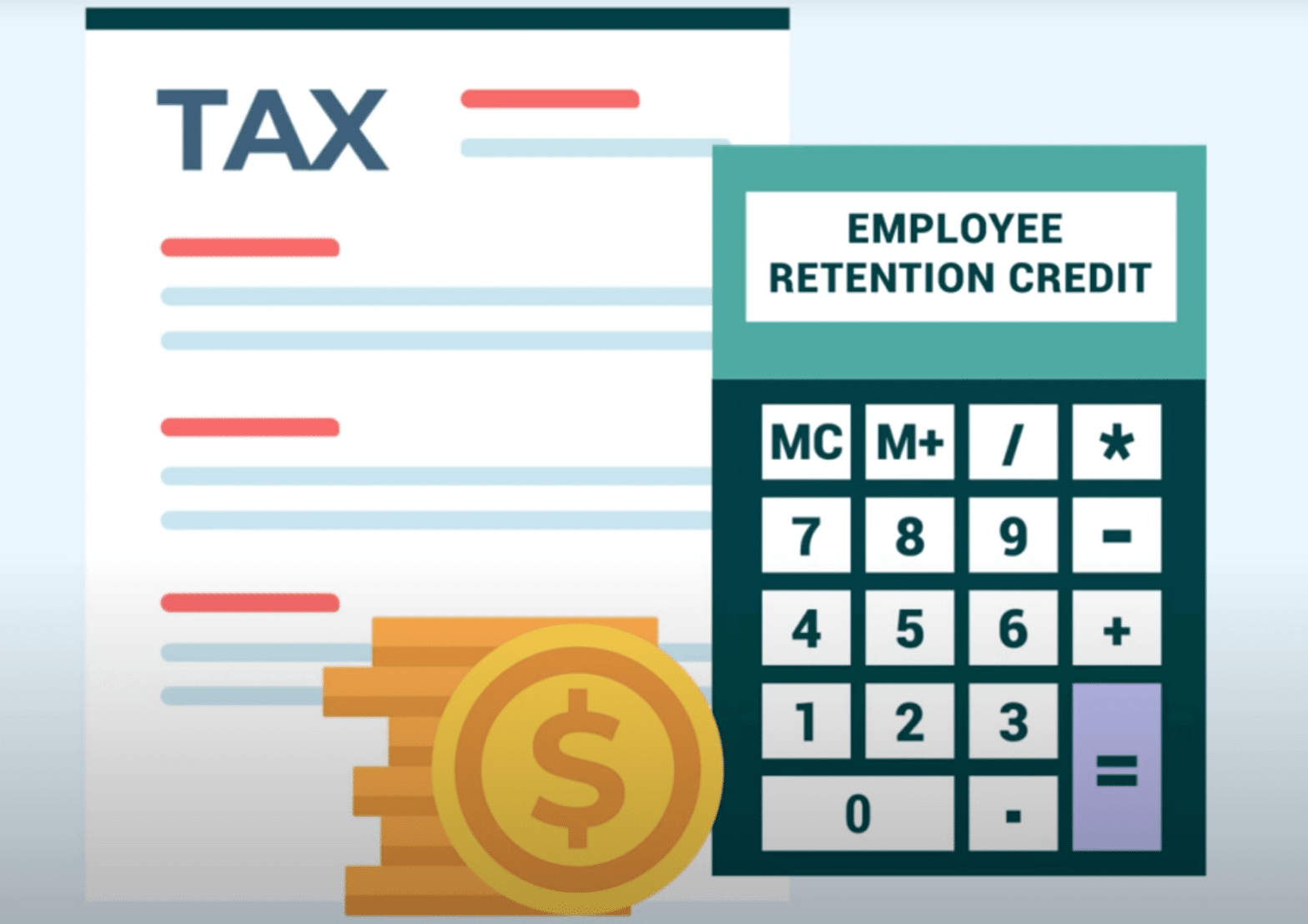

What Is The Employee Retention Credit (ERC) and How Can You Benefit From It?

It’s tax filing season, and our clients are working hard to close out their 2022 filings. However, there’s a potentially huge payroll tax credit some businesses are missing – and we want to make sure that doesn’t happen to any of our clients! That tax credit is called the Employee Retention Credit (ERC). If you… Continue reading What Is The Employee Retention Credit (ERC) and How Can You Benefit From It?

How are Bonuses Taxed?

Bonuses are a popular way to increase employee loyalty and reward a year’s worth of “jobs well done”. However… as far as payroll goes, they are often misunderstood. With those holiday bonuses on the way, let’s cover one of the most common end-of-year payroll questions: how are bonuses taxed? It’s an oft-repeated question, especially at… Continue reading How are Bonuses Taxed?

Should You Pay an Employee Who Resigns With Two Weeks Notice?

When one of your employees puts in their two weeks notice, they may think that the heads-up time they’re giving you is doing you a favor. While the extra time to prepare for their departure can certainly help, you can run into some big time HR and Payroll headaches – especially if you aren’t aware… Continue reading Should You Pay an Employee Who Resigns With Two Weeks Notice?

Employment Record Retention: What Are the Federal Laws?

An important question to ask yourself when dealing with employment (and really any business-related paperwork) is how long are you required to keep the records? Unfortunately when it comes to record retention, there is a myriad of answers and a multitude of regulations for different scenarios. We’ve summarized the most common federal laws that relate… Continue reading Employment Record Retention: What Are the Federal Laws?

Tax Filing Tips for 2022

Tax filing season is here, and the IRS is encouraging individuals to assess their tax situation as the deadline to file approaches. Take a moment before you start on your taxes for the year to read up on the special steps involved in assessing your advance child tax credit payments, your economic impact payments and… Continue reading Tax Filing Tips for 2022

How Easy is it to Outsource Your Payroll?

The decision to outsource your payroll can seem like a difficult one, but it’s well worth it. Not only will outsourcing your payroll to Capital Payroll Partners save you untold amounts of time, but you’ll also be insuring that your business is compliant with ever-changing regulations. That all sounds great, right? Here’s even better news:… Continue reading How Easy is it to Outsource Your Payroll?

Why Choosing a Local Payroll Provider is the Right Decision for your Business

Large businesses of 500+ employees are typically able to have their own, in-house payroll department, or have big money deals in place with the payroll giants to handle it for them. But the vast majority of small and medium businesses are not able to fund their own payroll department (complete with salaries, benefits, insurance, etc… Continue reading Why Choosing a Local Payroll Provider is the Right Decision for your Business