DOL Increases Minimum Salary for Exempt Employees

The U.S. Department of Labor (DOL) has set increases to the minimum salary for many exempt employees. This is a significant change that will impact businesses nationwide. Here’s a breakdown of what you need to know: The Increase: The new rule implements a two-step increase for exempt executive, administrative, and professional employees (EAP): Current: Minimum salary… Continue reading DOL Increases Minimum Salary for Exempt Employees

New I-9 Rules for 2024: Everything Employers Need to Know

The Internal Revenue Service (IRS) has released a new version of Form I-9, Employment Eligibility Verification, which will be required for all new hires starting in 2024. The new form includes some important changes that employers need to be aware of. Review the new I-9 rules for 2024 below. New E-Verify Checkbox The new Form… Continue reading New I-9 Rules for 2024: Everything Employers Need to Know

Employee Tax Withholding: Advice for Employers

Tax season is here, and it’s likely that at least one of your employees is asking you why their refund was so big this year, or worse… why they owe so much money. You’re not a tax professional so if you don’t know the answer, that’s normal! However, we’re here to give you some quick… Continue reading Employee Tax Withholding: Advice for Employers

Companies Need To Pay Attention to Gen Z

Finding reliable and retainable talent is an issue for every business – from the Fortune 500 companies to the small and medium-sized businesses (SMBs) down the street. One of the best ways to attract and retain talent, and to create a longstanding and enduring company culture, is to curate a multigenerational workforce… and that means… Continue reading Companies Need To Pay Attention to Gen Z

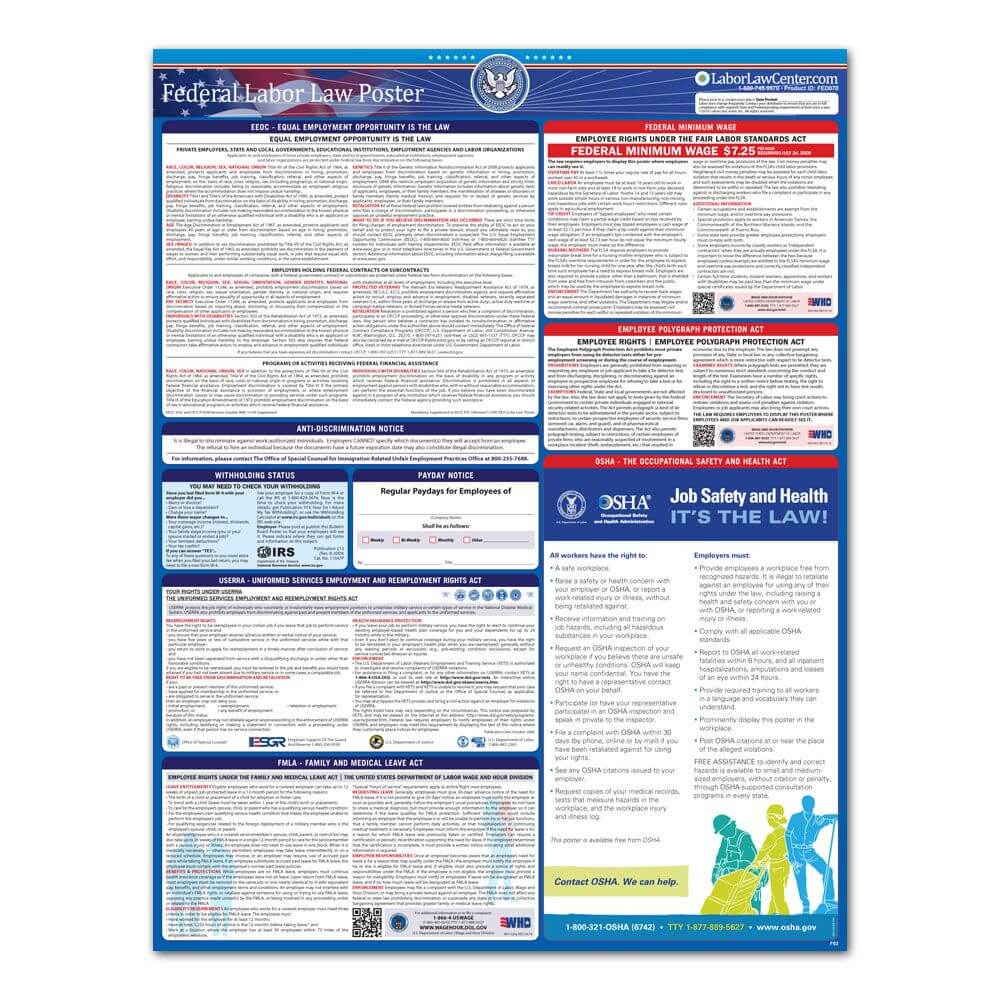

What You Need to Know about Payroll Compliance

If you’re a small or medium sized business, making sure you stay compliant with payroll regulations and laws can be a daunting task. If your company’s not big enough to have an in-house payroll compliance specialist, we strongly advise you outsource to a Small Business Payroll Specialist or you could potentially run the risk of… Continue reading What You Need to Know about Payroll Compliance

Small Business Payroll Specialist

For many small businesses, payroll can be one of the most challenging tasks you take on – and the one you’re least happy about dealing with month-in and month-out. After all: payroll is complex, confusing, the rules change frequently, and a mistake can cost you or your employees money… literally. However, you have options… and… Continue reading Small Business Payroll Specialist

Remote Work Cybersecurity: How To Protect Your Business in the Age of Remote Work

In 2020, the Federal Bureau of Investigation recorded 1.4 million cybercrime complaints – an increase of around 750,000, from the year prior. The most numerous complaint was identity theft – and the time period reported in these statistics correlates directly to the shift from office work to remote work due to the COVID-19 pandemic. This… Continue reading Remote Work Cybersecurity: How To Protect Your Business in the Age of Remote Work

Can You Make Direct Deposit Mandatory?

A question we’re often asked when a new small or medium-sized client chooses us for payroll outsourcing is whether or not they are able mandate that their employees use direct deposit for their paychecks. With over 82% of US employees choosing to be paid by direct deposit, it’s clearly extremely popular. In all honesty, there’s… Continue reading Can You Make Direct Deposit Mandatory?